More Than One Way to Get Paid

When starting a business, few people think much about how they’ll get paid. It seems simple: you make or do something for the client and they pay you. Right?

Well, yes and no. There are many revenue structures. And choosing the right one can be important to both customer satisfaction and your business’s profitability.

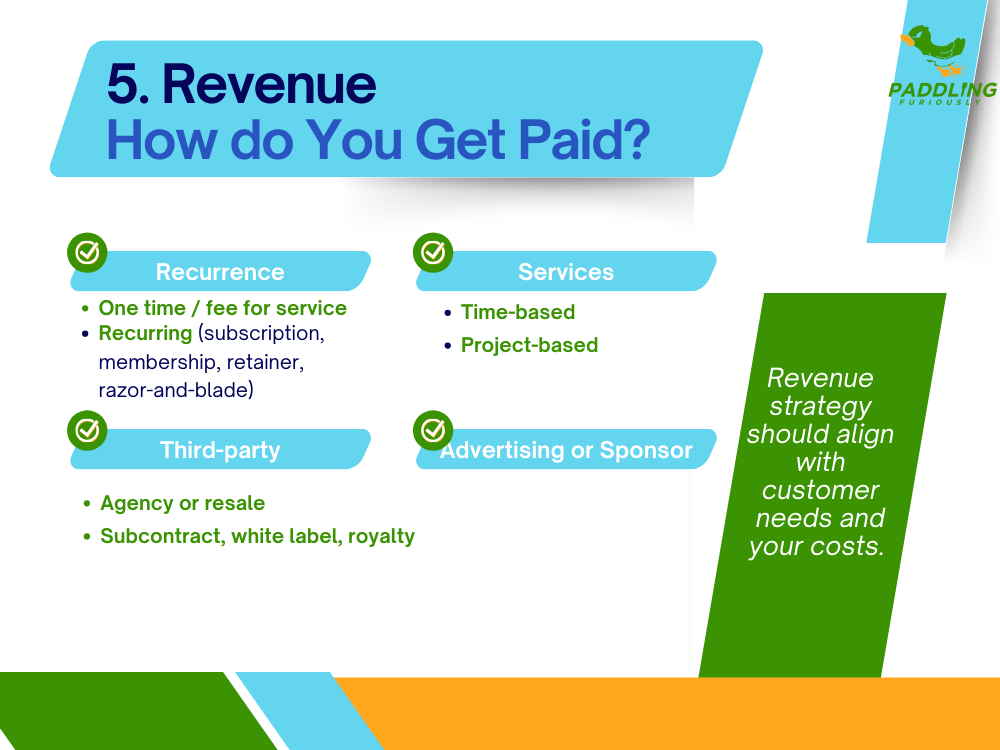

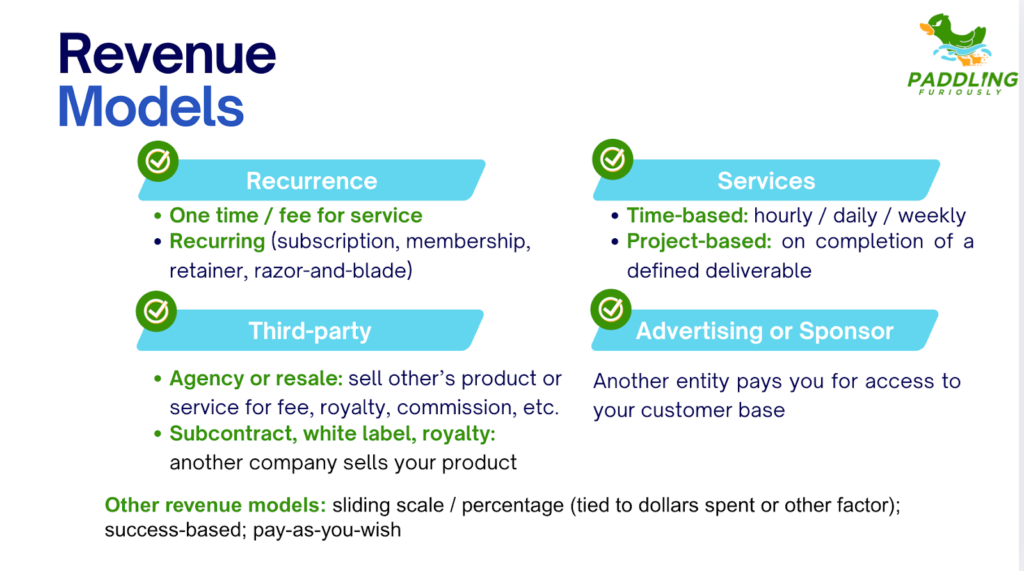

Revenue models

The chart below outlines various payment strategies. The right choice for your business will depend on your business, objectives – and stage of growth, as new opportunities may arise as the business evolves. Even if you choose to go with the tried-and-true fee-for-service model (you do or sell something; you get paid), it’s worth evaluating what other options might be available.

- One time v. recurring: recurring revenue is very attractive. Who wouldn’t want a regular income stream? But the customer will only pay a subscription or membership for a product or service they receive and use regularly, and from which they derive ongoing value.

- Services: service providers often default to charging hourly; it’s easy to calculate and you know your time is paid for.

- However, it can be less clear to the customer (how long will that website design or cleaning project take?).

- It’s also hard to scale: as you get more efficient at providing the service, you’ll face a pay cut, unless you raise rates. For many, project-based pricing is clearer and provides more profit potential.

- Project-based pricing, however, requires that you can estimate how long it will take; otherwise, you risk costly overruns.

- Third-party: there are many good reasons to control both the customer relationship and product delivery or provision of service. However, when you’re starting out, testing a new product or channel, targeting a different customer segment or want to offer a product or service occasionally, it may make sense to utilize a third-party model.

- Agency or resale: your company sells a third-party product or service for a fee, commission, royalty, markup or other payment

- Freemium models allow a user to access a service at a low – or sometimes no – fee so they can become familiar with the service and, potentially, migrate to higher-cost tiers at a later date

- Ad-supported: would others like to reach your customer base? If so, advertisers or sponsors may be a potential supplemental (or sole!) revenue source. This is a difficult strategy for young companies, however, which have not yet established their audience demographics, metrics and engagement.

Customer Usage and Value

Customers pay for things that have value to them; if I’m thirsty, I’ll pay for a drink. When the transaction gets more complex than an afternoon snack, though, pricing can get complicated too.

Key components of customer value perception can include:

- One-time v. ongoing value: customers are unlikely to sign up for a subscription, membership or other recurring payment arrangement unless they perceive ongoing value delivery. Your logo has ongoing value to your business, but the designer performed a one-time service, so you may be unwilling to pay a royalty or subscription.

- Predictability: the cost of providing an ongoing service may vary, but the customer may prefer the predictability of of a regularly priced service

- Customization: customers may value – and pay more for – a personalized product or service (thus offsetting the additional cost)

- Urgency: customers are often willing to pay more to address an urgent problem or to receive their product or service quickly

Cover your costs

The customer must receive value in order to be willing to pay, but you also want to make a profit. So it’s important to understand when and what type of costs you’ll incur to service the customer.

- Upfront: you may need to purchase equipment, pay for software or other services or devote time and effort to customizing the product or service and onboarding the client

- Ongoing: a service business (or the service component of a product sale) will often incur costs (equipment, supplies, personnel, your time) to support the service. It’s important to understand the variables that affect these costs – and make sure your pricing to recoup them

- Sales cycle: expensive or complex products and services may entail a lengthy, engaged sales cycle, often with a comparatively low close rate. That time – all of that time; even the deals that don’t close – are part of the costs of your business and should, ideally, be covered

- Retention: with an ongoing service or repeating product (subscription, razor-and-blade), retaining the client longer term will be key to overall profitability. Pricing structure – including elements such as freemium or upfront costs discussed above – is key to profitability

Time is money: time is one of the most important – and most often overlooked – cost components. Make sure you’re considering the time component in all of the above categories

Access our pricing worksheet, to better understand the lifecycle costs of your customers and figure out which pricing models work best for your business.

Don’t ignore the competition

Just like any other aspect of business planning, pricing decisions shouldn’t be made in a vacuum. It’s helpful to understand competitive pricing, including:

- How much competitors charge: benchmark your prices compared to similar products or services

- How competitors charge: One-time or recurring? Upfront or later? Are there fees for customization or other add-ons?

You don’t have to charge what or how competitors do, but it’s useful to know!

- Subcontract, white label, royalty: your product or service is distributed by another company for a fee, commission, etc.

- Ad- or sponsor-supported: another entity pays you for access to your customer base

- Other revenue models: sliding scale / percentage (tied to dollars spent or other factor); success-based; pay-as-you-wish

Timing Matters!

Another key consideration is timing. Most revenue models can be adjusted based on customer preferences and company needs.

- Early or prepayment: early payment can enhance cash flow and ensure costs are covered. Most revenue types can be collected prior to, at the time of or following delivery of the product or service

- Some involve a combination; for example, a lengthy project will often include a deposit (prepayment), interim or milestone payments and a final amount payable

- Almost any revenue type can be collected in advance; typically, a discount is offered. For example, a $10 / month subscription might cost $100 if a full year is purchased in advance

- Upfront / freemium: many recurring, service or contractual payments are adjusted so that early payments differ from ongoing charges

- Upfront (onboarding, training, etc.) fees are typically charged when significant additional work or customization is required prior to delivery of an ongoing service

Want to learn more?

Revenue Planning Tool: assess your costs; evaluate which revenue models work for your business

Business Model Canvas: a simple plan to turn your product or service into a business